On August 9, 2021, the international conference was co-organized by VNU University of Economics and Business and Baoviet Holdings, with the theme of "Financial Consumer Protection: Practices and Policy Recommendations for Vietnam" attracting more than 200 domestic and international guests. In recent years, Vietnam has seen a remarkable development in terms of quality, quantity, and accessibility of financial products and services. This requires not only efforts from financial service providers or consumer awareness raising, but also the involvement of regulatory agencies in formulating and enacting practical, efficient policies to meet the requirements in the context of Vietnam's rapidly developing new financial services. As a result of this, the international conference titled of "Financial consumer protection - Practices and policy recommendations for Vietnam," was co-organized by the University of Economics - Vietnam National University, Hanoi. (VNU) and Vietnam Deposit Insurance on August 9, 2021, with over 200 domestic and international guests registered.

The conference is

sponsored by the National Foundation for Science and Technology Development

(NAFOSTED) as part of the International Academy of Financial Consumers' Annual

Conference (IAFICO). The program provides a forum for management units,

scientists, and experts from both within and outside the country to share their

experiences, perspectives, and knowledge, as well as offer practical solutions

to human protection issues. Vietnam's financial consumption (BV NTDTC).

Professor Man Cho, President of the International Academy of

Financial Consumers; Dr. Dinh Thi Thanh Van, Vice Dean of Faculty of Finance

and Banking, VNU University of Economics and Business, Founder, Vietnam

Personal Finance Network; Prof. Dr. Andreas Stoffers, SDI Munich, International

University of Applied Sciences; Mr. Klaus Remmer, Sparkasse Esslingen; Prof.

Dr. Andreas Stoffers, SDI Munich, International University of Applied Sciences;

and Prof. Dr. Andreas Stoffers, SDI Munich were guest speakers.

With this goal in mind, the guest speakers, managers, and

researchers have thoroughly examined and analyzed the issues of (1) Discussing

Vietnam's policy proposals for protecting consumers' financial use; (2) Sharing

experiences on the development of the Financial Consumer Protection Law and

challenges in implementing these regulations in the banking sector in countries

around the world; and (3) Digital consumer protection practices in Vietnam and

other countries; (4) Present a bank's practical experience in protecting its

customers' finances. These issues are thoroughly examined and debated at the

conference through exchanges and sharing, as well as research contributions

from domestic and international authors. These detailed studies and information

will serve as the foundation for practical solutions and policies to ensure the

safety of Vietnam's financial consumers. Many prestigious domestic and

international experts and researchers attended the international conference on

Financial Consumer Protection: Practice and Policy Recommendations for Vietnam.

Over 200 domestic and international guests participated in the international conference

Evidence and lessons

from NTDTC around the world

Prof. Man Cho, President of the International Financial

Consumer Academy, spoke about NTDTC BV's role in the digital transformation

process, focusing on the company's experience in developing Korea's Financial

Consumer Protection Law concept of "financial consumer protection" as

well as demonstrating Fintech development trends, digital transformation, and

its impact on financial services. Most countries, including Vietnam, have

policies in place to protect against NTDs, according to experts. The three main

pillars of consumer protection policy are: Financial education and counseling

for consumers (Financial education and counseling for consumers); Measure FCP

from the supply side (Ex ante or before POS); Policy instruments. More research

on KPIs is required to determine how effective FCP policies are being

implemented and how well they are being reflected in different countries.

According to

Prof. Man Cho, most countries, including Vietnam, are still in the early stages

of developing NTD protection policies

Prof. Andreas Stoffers presented evidences about consumer

protection in the content "Challenges in enforcing consumer protection

regulations in the banking industry - Risk level and feasibility."

Consumer protection in the European Union, Germany, and the banking sector.

According to experts, it is necessary to strike a balance between user

protection and condition requirements so as not to jeopardize consumers'

responsibility and freedom. The most important thing to do today to address the

issue of consumer protection in Vietnam should begin with financial education

for consumers.

Speaker Klaus Remmer introduced some basic NTDTC protection

laws in German banks from the practical perspective of banking in Germany. In

this country, NTD protection comes from a variety of sources, including the

government, non-governmental organizations, and financial institutions (such as

Sparkasse Essen Bank). According to the speaker, consumers should not rely

solely on consumer protection services because there will always be new

products that the regulations have not kept up with. Young people are

frequently victims of indifference and lack of experience. As a result, it is

preferable if customers have a basic understanding of financial transactions

and are able to assess and anticipate the risks associated with their

decisions.

Vietnam's digital consumer protection practices and policy

recommendations

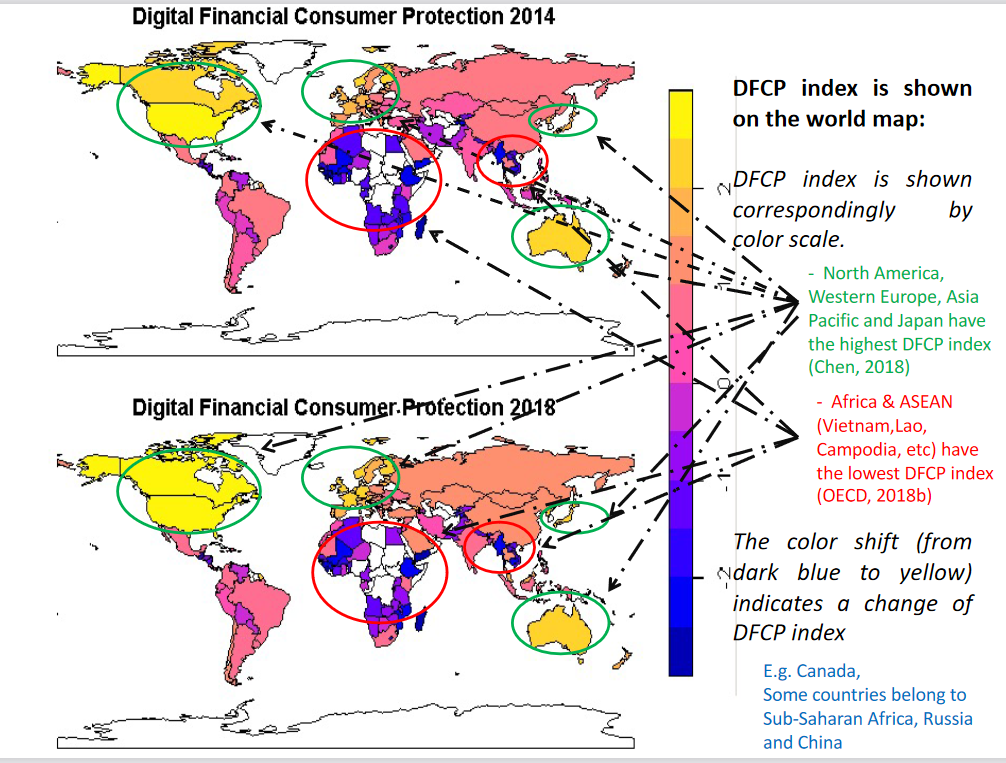

Dr. Dinh Thi Thanh Van discussed the development of a

national index of Digital Financial Consumer Protection (Digital Financial

Consumer Protection) in Vietnam and other countries, providing an overall

picture of digital consumer protection in Vietnam and other countries (DFCP).

The speaker highlighted three key current issues concerning the current state

of Digital Financial Consumer Protection: Consumers of digital financial

services face numerous challenges, including information asymmetry and a lack

of sufficient information on new financial products and services; vulnerable

groups (low income, poor, women, etc.) may be more disadvantaged or even

excluded from digital financial services, leading to inequality; and a lack of

protection mechanisms will reduce social trust, which in turn will lead to

inequality. From 2014 to 2018, the study built models and calculated the

Digital Financial Consumer Protection Index (DFCP) of 135 countries around the

world, identifying the main factors influencing this index and then making

policy recommendations.

Dr. Dinh Thi

Thanh Van's analysis of the World DFCP Index Map

Dr. Dinh Thi Thanh Van stated that based on the calculation

results, Vietnam and some Southeast Asian countries have the lowest DFCP index.

This indicator is influenced by four groups of factors: Education and society,

technological infrastructure, market size, and organizational innovation. They

are all important considerations. It is critical to improve the DFCP index in

Vietnam by increasing economic competitive pressures (e.g., joining bilateral

and multilateral trade agreements; improving government accountability;

government; perfecting the legal system, etc.); supporting research and

innovation (e.g., investment in R&D activities at universities); and building

and improving digital platforms (internet coverage, line speed...). It is

critical to improve consumer financial literacy through financial education,

learning, and self-awareness. Governments must establish regulations to ensure

information transparency, improved accountability, and consistent, official

sources of financial assistance information.

According to Prof. Man Cho, each country has its own

characteristics, applying laws on NTD protection from other countries to

Vietnam is therefore not recommended. Vietnam must create its own laws that are

appropriate to the country's circumstances.

Prof. Andreas Stoffers emphasized that the two most

important aspects of consumer finance protection in Vietnam are simultaneously

developing a framework for legal regulation and financial education.

Furthermore, the issue of data protection and user personal information must be

addressed. According to many studies, Vietnam has the highest number of

cryptocurrency trading accounts in the world, so it is best to focus on

learning about these digital currencies and developing regulations or

conducting research. Central Bank Digital Currency (CBDC) research is currently

being actively deployed in China.

The Organizing Committee of the conference published the

Proceedings of the International Scientific Conference, titled "Protecting

Financial Consumers: Practice and Policy Recommendations for Vietnam," in

both English and Vietnamese. We received 29 research papers from experts,

researchers, and lecturers from domestic and international universities . In

addition to the outstanding issues of financial consumer protection that have

been raised, the conference contents and conclusions have received widespread

agreement and support from researchers and domestic and international experts.

This will be the first step for VNU University of Economics and Business in

contributing appropriate recommendations to state agencies in making

appropriate and timely policies in the field of finance and banking in Vietnam.

>> Click here to see the title in Vietnamese.