In the field of finance and accounting, the transformation of policies and regulations related to the application of international financial reporting standards in Vietnam is considered an important factor in helping businesses to integrate entry and access to an even higher level of international financial markets.

In the field of finance and accounting, the transformation of

policies and regulations related to the application of international financial

reporting standards in Vietnam is considered an important factor in helping

businesses to integrate entry and access to an even higher level of

international financial markets. To keep pace with those changes, during

2021 and early 2022, the Faculty of Accounting and Auditing under VNU

University of Economics and Business organized a series of seminars on

financial, accounting and tax policies for students. graduate students and

practitioners of the financial accounting profession to build a community of

research and sharing practical policy advice.

In the context of

globalization and comprehensive international integration, Vietnam's economy is

subject to the conventions of international general regulations, and at the

same time there is a change in the system of policies, laws, and thinking.

socio-economic management. In the field of finance and accounting, the

transformation of policies and regulations related to the application of

international financial reporting standards in Vietnam is considered an

important factor in helping businesses to integrate entry and access to an even

higher level of international financial markets. To keep pace with those

changes, during 2021 and early 2022, the Faculty of Accounting and Auditing

under the University of Economics - VNU organized a series of seminars on

financial, accounting and tax policies for students. graduate students and practitioners

of the financial accounting profession.

The topics of the

seminars showed diversity when discussing changes related to financial,

accounting, auditing, risk management and tax policies; exploited from

many different angles, from policy makers, practitioners to researchers at home

and abroad. Some seminars attracted a large number of interested people

such as " Accounting profit and taxable income", "The impact of

COVID-19 on accounting and auditing", "Management Information

Seminar: The Stage of Accounting" Practice", "Strategic Cost

Management"...

Highlights of the talk

show

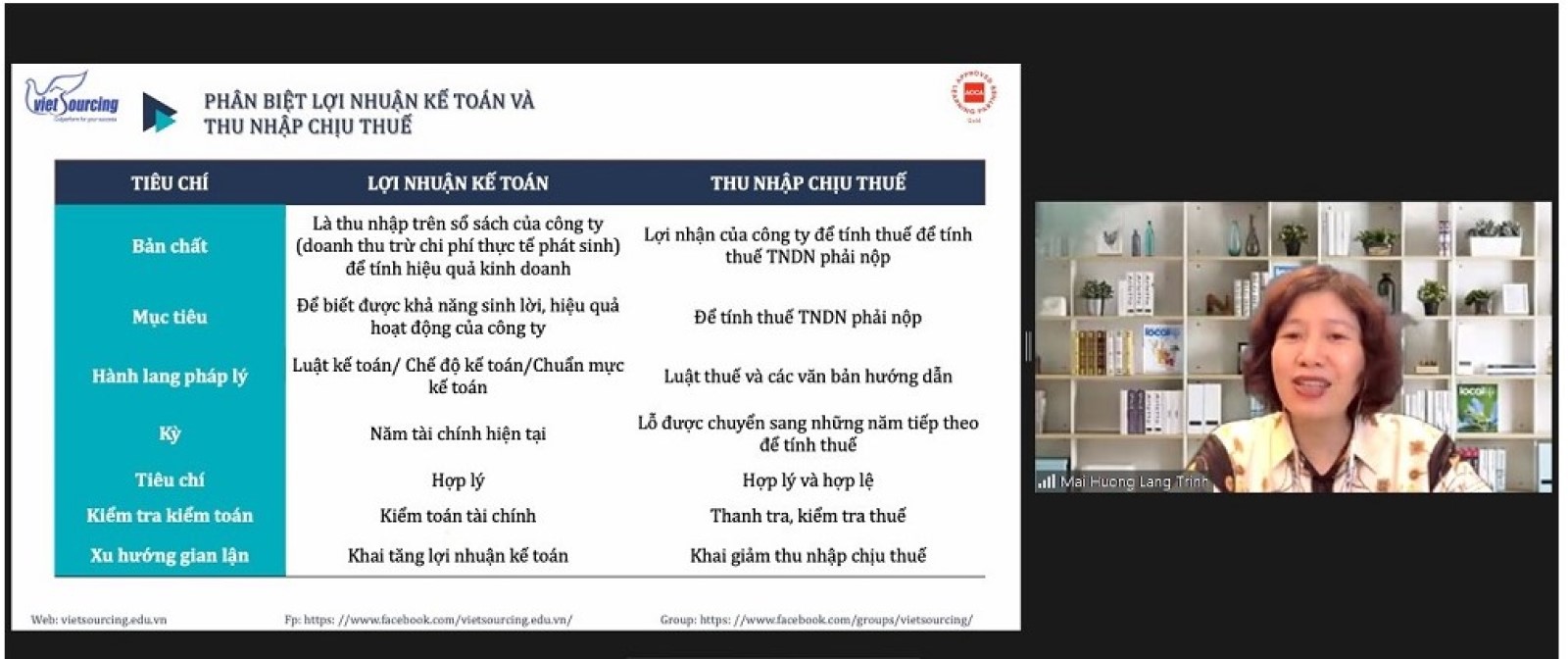

With the theme "Accounting profit and taxable income", the seminar

attracted more than 50 participants. The speaker of the seminar was Ms.

Lang Trinh Mai Huong - Deputy Director of the School of Auditing and

Professional Training, State Audit; founder of Viet Resource Company

(Vietsourcing); served as the representative of Vietnam at the British

ACCA International Committee for the 2010-2011 term; The first

representative of Vietnam at the International Federation of Accountants (IAFC)

and an expert with more than 20 years of experience working and teaching in the

field of accounting - finance - auditing - tax. At the seminar, speaker

Lang Trinh Mai Huong shared his knowledge and experience in applying new

regulations on handling taxable income. She

received a lot of questions from students and guests on issues related to tax

legislation, accounting standards, and tax optimization in businesses, thereby

giving the exchanges stemming from many different perspectives. Also

in the talk, Dr. Nguyen Thi Hong Thuy - Dean of the Faculty of Accounting

and Auditing shared her experience in applying tax planning and new points in

the approach to determining accounting profit and taxable income in Vietnam.

Ms. Lang Trinh Mai Huong - Deputy Director of the School of

Auditing and Professional Training, State Audit at

the seminar " Accounting profit and

taxable income"

With the topic "The

impact of COVID-19 on accounting and auditing", expert Nguyen Manh

Hien from An Viet Auditing Company shared international accounting standards as

well as assessed the effects of COVID-19. -19 to accounting. Experts also

share about new regulations such as regulations of Vietnamese Financial Reporting

Standards (VFRS) on “Reports of Directors”, which requires management to

present aggregated information in the context of the financial statements, to

express opinions, as well as such as explaining goals and strategies. From

there, users of the information in the financial statements will clearly

understand the impacts of COVID-19 and the prospects of the business. The

expert also discussed the application of some standards in the international

financial reporting standard system such as IFRS 13 “Measurement of fair

value”, VAS 23/IAS 10 “Events arising after the closing date at the end of the

accounting period", VAS 01/IAS 01 "General Standard" or

"Presentation of the Financial Statements" applies to uncertainties

in accounting estimates and the going concern assumption. Experts

emphasize that assessing going concern is reporting all material uncertainties

that existed at the approval date of the financial statements in a clear and

concise manner. The company's board of directors also needs to present its

assessments and solutions to minimize the impact of COVID-19 on its business to

help readers understand the financial statements. compliance with the going

concern assumption.

Dr. Nguyen

Thi Hong Thuy - Dean of the Faculty of Accounting and Auditing, VNU-UEB,

discussed with speakers and students at the seminar

A series of seminars organized monthly by the Faculty of

Accounting and Auditing in the online form, with the participation of many

experts from domestic and international businesses and professional

associations.

With the theme

"Strategic Cost Management", the seminar brought together two The

speaker was Mr. Phan Le Thanh Long - Chief Representative of CMA Australia in

Vietnam, an expert with over 20 years of experience in auditing and consulting

and Dr. Nguyen Thi Phuong Dung, lecturer at Hanoi University of Science

and Technology with nearly 20 years of teaching and research experience in

accounting and auditing. At the seminar, expert Phan Le Thanh Long shared

about the application of Activity-based Costing in the fields of production and

services. He also shared about practical experience in Vietnamese

enterprises based on the consultations he has carried out, barriers and

difficulties when implementing at enterprises such as VietinBank, Hai

Confectionery Joint Stock Company. Ha or Military Industry and

Telecommunications Group (Viettel)… In which, Besides,

the speaker also shared important principles of lean management as well as

experiences to build a lean management system in the enterprise…

At

the talk, Dr. Nguyen Thi Phuong Dung shares her experience in applying

cost management reports in different types of businesses. She also gives

suggestions to start with modern cost management accounting techniques to help

accountants plan and control costs in all areas of an organization's

activities. apply techniques that are being applied at multinational firms in

data analysis in all aspects such as marketing, human resource management, risk

management, setting up control systems, and ending with reports. Management

aims at social responsibility and ensures the sustainable development of the

organization.

Speakers

Nguyen Thi Phuong Dung and Phan Le Thanh Long at the seminar "Strategic Cost Management"

Policy advice drawn

from the series of talks

With diverse topics,

the seminars aimed at a common point that was to make proposals to adjust the

system of policies and regulations, and at the same time to give suggestions in

practicing accounting and auditing profession.

Firstly, businesses need to

carefully prepare for the application of international financial reporting

standards according to the roadmap set out by the Ministry of Finance. In

particular, in the current period, it is necessary to pay attention to applying

standards related to the impact of COVID-19 on accounting and auditing.

Second, proactively plan

financial and tax plans towards the sustainable development of the

business. Businesses need to clearly define short-term and long-term goals

to determine appropriate strategies and responses in the changing business

environment. The application of new techniques in management accounting or

new accounting approaches should be aimed at the long-term goals of the

business, sustainable development. In particular, managers and businesses

also need to determine the operating mechanism, ensure compliance with

environmental regulations, innovate technology and improve production

efficiency.

Third, towards the

development of the digital economy, there needs to be a shift from businesses

and managers in the approach to formulating business management and

administration policies. As the cashless economy expands, policies need to

evolve accordingly. For businesses, the accounting system of enterprises

also needs to integrate, ensure optimal operation, effectively use the

integration of multi-dimensional goals of the accounting information system

including tax, Disclosure of information to related objects.

With attractive,

practical and attractive topics from reputable speakers, the seminar series of

the Faculty of Accounting and Auditing, University of Economics - VNU has

achieved great success and is highly appreciated. from the

participants. This is the starting point for the Faculty to continue to

continue its successes and expand the research and policy consultation

community.

<< Click here to see the title in Vietnamese.